This article is based on a brochure about MLTC. You can read it online or download this printable version. Scroll to the end to view versions in other languages.

How to use this brochure

You can read this brochure from the beginning if you don’t know anything about managed long term care.

You can also use the Table of Contents to skip straight to your question.

If there’s anything you don’t understand or want more information about, you can always call ICAN at (844) 614-8800.

If there’s anything you don’t understand or want more information about, you can always call ICAN at (844) 614-8800.Table of Contents

What is MLTC?

What kinds of MLTC plans are there?

Who must join an MLTC plan?

ICAN can help you.

What is MLTC?

MLTC stands for Managed Long Term Care.

Long term care means services that help you with your daily activities. Examples are home care attendants, day care programs, and nursing homes. You might need long term care services if you need another person to help you clean your home, get dressed, or take a shower.

Many New Yorkers who need long term care get it through Medicaid. And most people with Medicaid must get their long term care through an MLTC program.

The “M” in MLTC stands for managed. MLTC is a type of health insurance called managed care. You must join a plan offered by a private health insurance company to get Medicaid to pay for your long term care. Medicaid pays these companies to provide long term care to their members.

In order for the plan to pay for your care, you must go to providers in the plan’s network.

Health insurance pays for medical care like doctors, hospitals and drugs. But most health insurance doesn’t pay for long term care.

All of the six MLTC programs described below cover services like home care, adult day care, nursing home care, medical supplies, and transportation services. However, availability of other long term care services varies among the six programs.

When you join an MLTC plan, you will get a Care Manager. This person will visit you at least twice a year and help you get the care you need. You can call your care manager whenever you have questions or problems.

What kinds of MLTC plans are there?

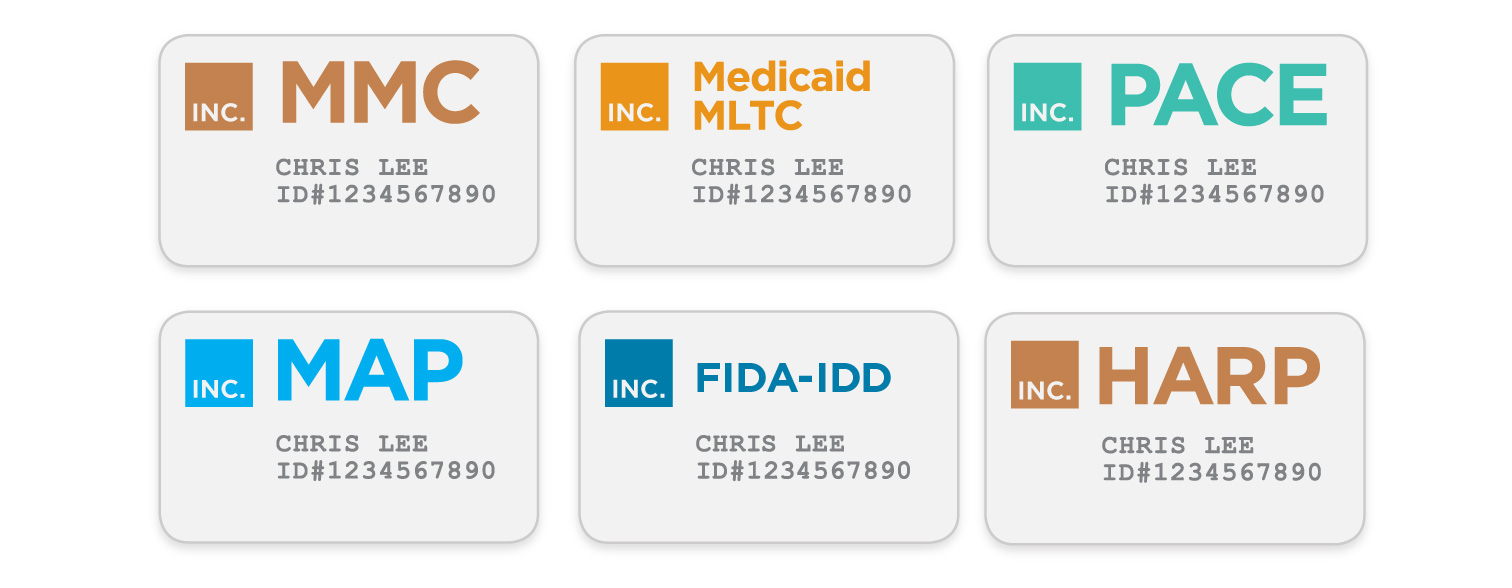

There are six different kinds of Medicaid health insurance that include long term care. Each kind of plan may cover different services. But all plans of the same kind must cover the same services. Which kind is right for you depends on whether you also have Medicare.

If you have Medicaid but don’t have Medicare, you probably get your Medicaid health insurance through a Mainstream Medicaid Managed Care (MMC) plan or Health and Recovery Plan (HARP).

Mainstream Medicaid Managed Care (MMC)

These plans cover all of your doctors, hospitals, medications, and also your long term care services. You generally do not need a separate MLTC plan to get long term care services.

Health And Recovery Plans (HARPS)

HARP is a type of Medicaid Managed Care plan for people with mental health or substance use disorders. Like MMC plans, HARPs cover all of your doctors, hospitals, medications, and long term care services. Like MMC, if you have HARP you do not need to switch plans to get long term care services.

To learn more about HARP, read our brochure Health and Recovery Plans, available online or by calling 844-614-8800.

If you have Medicaid only and need long term care, the rest of this brochure does not apply to you. Call ICAN for help.

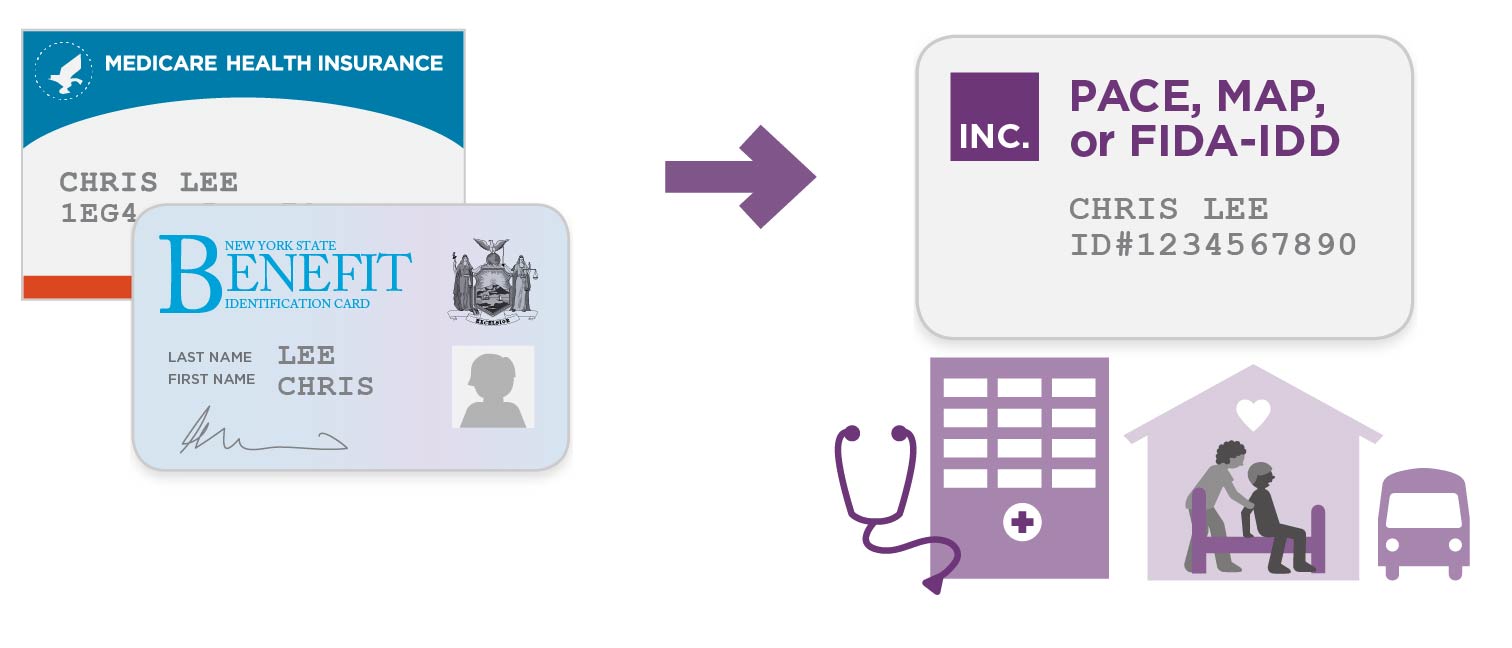

If you have Medicare and Medicaid, then you can choose from the following four kinds of plan: Medicaid MLTC, PACE, MAP, or FIDA-IDD.

Medicaid MLTC

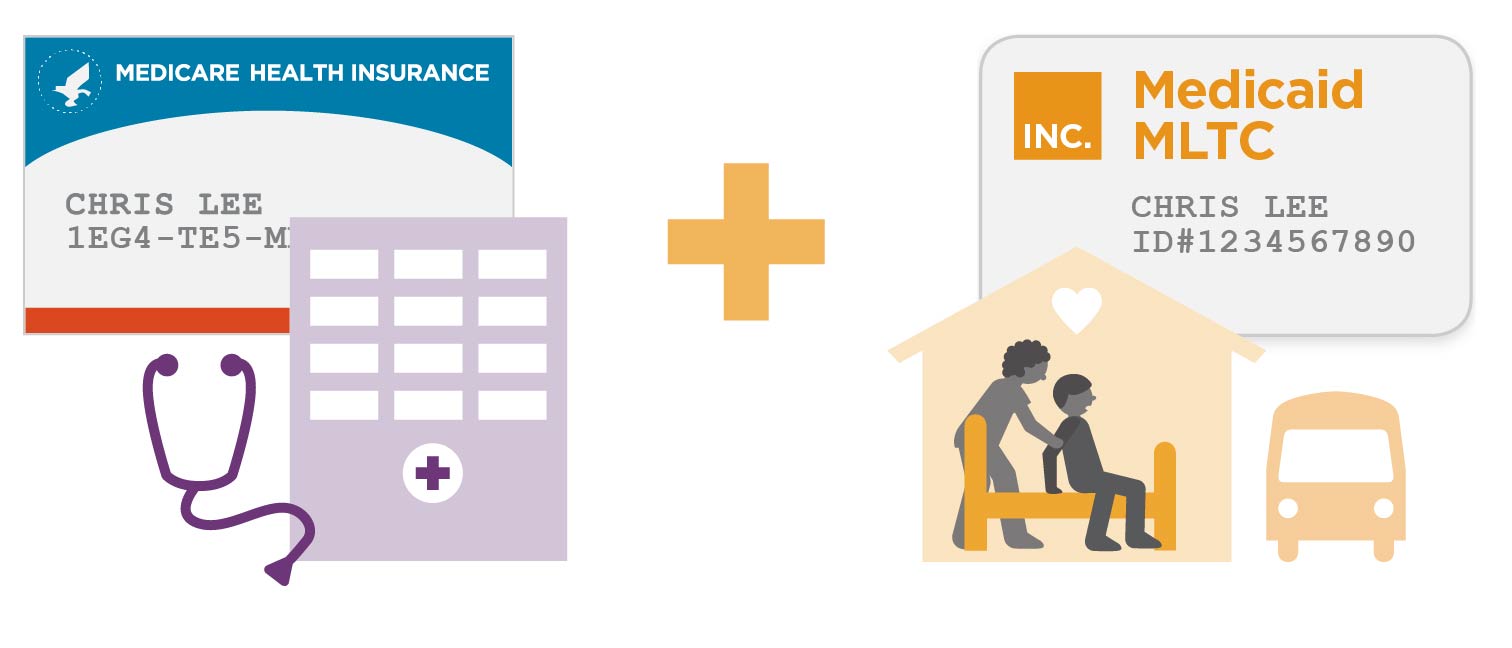

Most people with MLTC have this kind of plan, also called “partial-capitation MLTC.” It is called “partial” because it only covers part of your health care.

You would still have traditional Medicare and Medicaid for your doctors, hospitals, and other medical care.

Medicaid MLTC plans cover long term care and a few other services. With this type of plan, you would use your Medicare health insurance for your medical care. You could continue to see the same doctors you see now, because your Medicare health insurance would not change.

Here are some of the services covered by Medicaid MLTC:

- Home care (including personal care, home health aide,

and Consumer Directed Personal Assistance) - Adult day care

- Private duty nursing

- Physical/Occupational/Speech therapy

- Transportation to medical appointments

- Home delivered meals

- Medical equipment and supplies

- Hearing aids and audiology

- Eyeglasses and vision care

- Dental care

- Podiatry

- Temporary nursing home stays

Fully-Capitated Plans

The following three types of plan include all of the same services as Medicaid MLTC. But they also include all of your Medicare benefits.

They are sometimes called fully-capitated plans, because they are paid to provide both your Medicare and Medicaid benefits. With these plans, you would no longer use your Medicare card to get medical care. Everything would be through your plan. These plans are more convenient because you have only one insurance plan to worry about.

However, you need to make sure your doctors take the plan before you join. You also need to make sure that the hospitals, pharmacies, and other providers you use are in the plan’s network. If your provider is not in the plan’s network, then your insurance will not pay for you to see them.

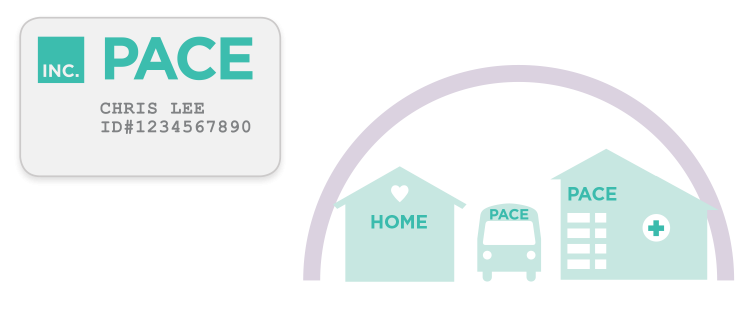

Program of All-Inclusive Care for the Elderly (PACE)

PACE combines Medicare, Medicaid and long term care services under one plan.

You have to be at least 55 years old to join PACE.

If you join a PACE, you must go to a center in your neighborhood to get most of your care.

The PACE center includes doctors and nurses who coordinate your care, as well as adult day care, meals, and other services.

PACE is not available everywhere in the State. But it is a great option for people who live near a PACE center.

If you disagree with a decision of your PACE, there are two different appeal processes depending on whether the service is covered by Medicare or Medicaid.

Medicaid Advantage Plus (MAP)

Medicaid Advantage Plus is like a Medicare Advantage plan combined with an MLTC plan. (Note: Medicare Advantage is a way to get your Medicare health insurance through a private managed care plan. Some Medicare beneficiaries choose to enroll in these plans.) Like PACE, MAP includes all Medicare, Medicaid and long term care services.

Age requirements vary among plans from 18+ to 65+.

Unlike PACE, there is no center you need to go to for your doctors and other care.

If you disagree with a decision of your MAP plan, there is one simple appeal process for all services.

Fully Integrated Duals Advantage for people with Intellectual and Developmental Disabilities (FIDA-IDD)

FIDA-IDD is a plan for people with Medicare and Medicaid who are eligible to receive services through Office for People With Developmental Disabilities (OPWDD).

Like PACE and MAP, FIDA-IDD combines all of your Medicare, Medicaid and long term care services into one plan.

In FIDA-IDD, you would be part of a team that can help you make decisions about your health care. Depending on your personal preferences, this team can include any family members or friends who help you, your doctor, and your care manager at the plan.

This team helps get you the services you need and makes sure all the parts of your health care are working together smoothly.

FIDA-IDD also covers waiver services, such as community habilitation, employment supports, and self directed care.

FIDA-IDD is only available in New York City, Nassau, Rockland, Suffolk, and Westchester.

To learn more about FIDA-IDD, see our brochure called A Plan for Me: FIDA-IDD, available online or by calling 844-614-8800.

Who must join an MLTC plan?

You must join a Plan if you answer “yes” to all of these questions:

- Are you currently enrolled in Medicare?

- Are you currently enrolled in Medicaid?

- Do you need long-term home care, adult day health care, nursing home, or other long term care?

- Are you age 21 or older?

If you answered “yes” to all of the questions, then you must choose a plan. (Note: There are a small number of exemptions, even if you answered “yes” to all of these questions. Call ICAN at (844) 614-8800 to find out more.) You can choose a Medicaid MLTC, PACE or MAP plan.

You will only be able to receive long term care services by joining a plan.

If you are already receiving Medicaid long term care services, you may already have been switched into an MLTC plan.

If you are applying for Medicaid long term care, you must choose an MLTC plan once you are approved for Medicaid.

ICAN can help you.

We can:

- Answer your questions about Managed Long Term Care plans.

- Give you advice about your plan options.

- Help you enroll in an MLTC plan.

- Identify and solve problems with your plan.

- Help you understand your rights.

- Help you file complaints and/or grievances if you are upset with a plan’s action.

- Help you appeal an action you disagree with.

Call 844-614-8800.

If you are hearing or speech impaired, you can use the NY Relay service by dialing 711.

ICAN can help.

Translations :

Downloads :

- What is MLTC? – Printable Brochure

- 什么是MLTC? - Printable Brochure (Chinese Simplified)

- 什麼是MLTC? - Printable Brochure (Chinese Traditional)

- ¿Qué es la MLTC? - Printable Brochure (Spanish)

- Qu’est-ce que MLTC ? - Printable Brochure (French)

- Che cos’è MLTC? - Printable Brochure (Italian)

- MLTC는 무엇입니까? - Printable Brochure (Korean)

- Kisa MLTC ye? - Printable Brochure (Haitian Creole)

- Czym jest MLTC? - Printable Brochure (Polish)

- Что такое MLTC? - Printable Brochure (Russian)